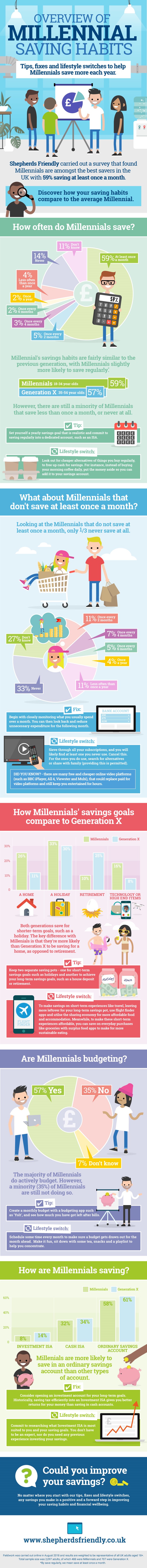

Despite the bad press that millennials often receive for regularly spending money on dining out and entertainment, they are in fact some of the best savers within the country with 59% putting money away at least once a month. Admittedly funds are generally saved towards short term goals like a holiday in preference of a home or retirement, but it's possible that this is due to the general cost of living being higher and these longer term goals appearing less obtainable in today's society.

The above infographic shares some important stats about the saving habits of millennials (those aged 18-34) and Generation X (those aged 35-54). Although many are saving money frequently which is great to see there's still a big percentage that aren't regularly popping the pounds away, if at all, which of course is a little concerning.

There are a few tips included which can certainly help you to save but being someone who puts funds away every pay day, without fail, and sets yearly targets, I have a few suggestions of my own which should have a positive impact on your bank (or ISA) balance.

There are a few tips included which can certainly help you to save but being someone who puts funds away every pay day, without fail, and sets yearly targets, I have a few suggestions of my own which should have a positive impact on your bank (or ISA) balance.